Real Property Gain Tax

Real Property Gains Tax (RPGT) is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. Which means that if one day you decide to sell your house, you have to pay taxes on the profit (gains) if you have any.

If you sell your house with a loss you don’t have to pay any RPGT because you didn’t make any profit. If you made a profit you need to make sure you pay the RPGT within 60 days of the sale. You can pay the RPGT by paying a fee for the solicitors of the sale. Paying yourself is also possible if you prefer that instead of dealing with a lawyer you can fill in the necessary forms for the Inland Revenue Board.

Now, here is some history about the RPGT. RPGT was suspended temporarily in April 2007 to December 2009, and reintroduced in 2010. In 2014, the RPGT was increased for the fifth straight year since 2009. Now, there’s about to be a revision to the RPGT for 2019. But first…

How is it calculated, and what kind of impact does it have on you?

Based on the Real Property Gains Tax Act 1976, RPGT is a tax on chargeable gains derived from the disposal of property. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. What most people don’t know is that RPGT is also applicable in the procurement and disposal of shares in companies where 75% of their tangible assets are in properties, a.k.a. Real Property Companies (RPC). RPGT applies to both residents and non-residents.

You will be only be taxed on the positive net capital gains which are disposal price less the purchased price less the miscellaneous charges such as stamp duty, legal fees, advertisement charges, etc. Additionally, a waiver on the taxable amount is granted to individuals (but not companies). The holding period is from the date on the Sales and Purchase Agreement (S&P) until the disposal date. For a quick calculation, the formula is:

Chargeable Gain = Disposal Price – Purchased Price – Miscellaneous Costs

Net Chargeable Gain = Chargeable Gain – Exemption Waiver (RM10,000 or 10% of Chargeable Gain, whichever is higher)

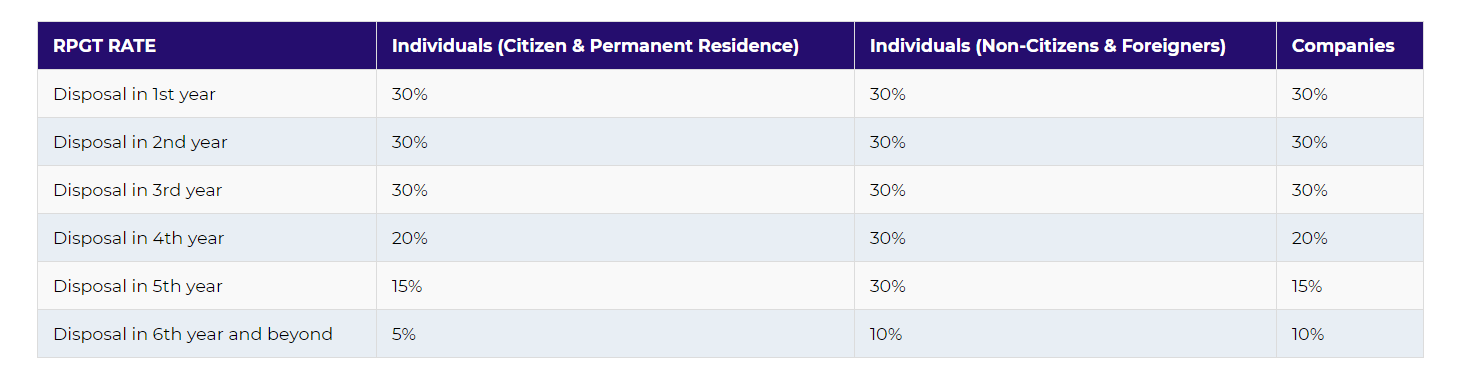

Tax payable = RPGT Rate (based on holding period) * Net Chargeable Gain

If you want to see a real example here you go:

Let’s say you purchased a house 12 year ago for RM500,000 now you want to sell it. The market price of the house is now RM700,000. To calculate the chargeable gain we minus the price RM700,000 by the original purchase price RM500,000 and any miscellaneous cost, let’s say we incurred a miscellaneous cost of RM10,000 from lawyer fees. The calculation goes as follows:

Chargeable Gain = Disposal Price – Purchased Price – Miscellaneous Costs

RM190,000 = RM700,000 – RM500,000 – RM10,000

Now we move onto the net chargeable gain. As mentioned above we can deduct the exemption waiver.

Net Chargeable Gain = Chargeable Gain – Exemption Waiver (RM10,000 or 10% of Chargeable Gain, whichever is higher)

RM171,000 = RM190,000 – RM19,000*

*10% of RM190,000 = an exemption waiver of RM19,000.

Tax payable = RPGT Rate (based on holding period) * Net Chargeable Gain

RM8,550 = 5% * RM171,000

You’ll pay the RPTG over the net chargeable gain. If you owned the property for 12 years,so you’ll need to pay RPGT of 5%.

RPGT Exemptions

Good news! There are some exemptions allowed for RPGT. Among the exemptions are:

- Exemption on gains from the disposal of one private residential property once-in-a-lifetime to an individual (please utilise this once in lifetime opportunity wisely).

- Exemption on gains arising from the disposal of real property between family members (e.g. husband and wife; parents and children; grandparents and grandchildren).

- 10% of profits OR RM10,000 per transaction (whichever is higher) is not taxable.

Other tools or reference which may be relevant to you.

- Home Loan Eligibility (how much loan you can borrow)

- Home Loan Calculator (how much monthly installment)

- Rental Yield Calculator

- Stamp Duty

- Legal Fees